By Tara M. Sinclair

Today, we’re fortunate to have Tara M. Sinclair, Associate Professor of Economics and International Affairs and a scholar at the GW Regulatory Studies Center at The George Washington University, as a Guest Contributor.

There has been a lot of debate lately about the costs of regulation for the US economy. In a Regulatory Policy Commentary posted on December 19th, Kathryn Vesey, a research associate at the GW Regulatory Studies Center, and I discuss our preliminary findings from a study of the macroeconomic impacts of changes in the “regulators’ budget,” i.e. the part of the US federal government budget allocated to developing and enforcing federal regulations.

We were inspired to take on our study by a policy bulletin from the Phoenix Center. They argue that federal regulatory expenditures are an enormous drag on the US private sector macroeconomy. Their abstract reports the following findings:

“Even a small 5% reduction in the regulatory budget (about $2.8 billion) is estimated to result in about $75 billion in expanded private-sector GDP each year, with an increase in employment by 1.2 million jobs annually. On average, eliminating the job of a single regulator grows the American economy by $6.2 million and nearly 100 private sector jobs annually. Conversely, each million dollar increase in the regulatory budget costs the economy 420 private sector jobs.”

Not surprisingly, these results have caught the attention of people concerned about federal regulatory spending, such as in this blog by House Majority Leader Eric Cantor and this Statement of Judiciary Committee Chairman Lamar Smith. We wondered, however, how sensitive the findings might be to different specifications.

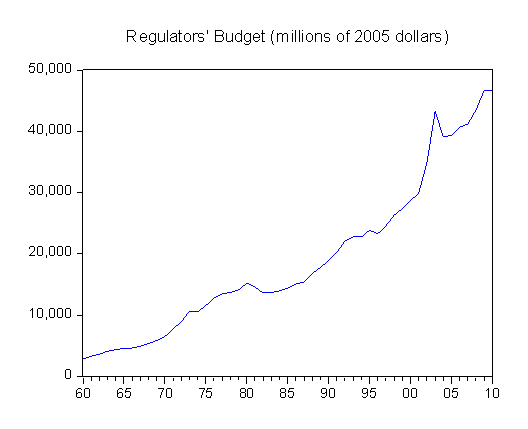

Therefore, we began with the same vector autoregression (VAR) framework as was used in the Phoenix Center study. Following their approach we measured regulatory agencies’ budgets based on data provided by Susan Dudley and Melinda Warren in their annual report on the regulators’ budget, although we updated the data by one year as compared to the Phoenix report. Here’s a graph of the data:

Source: Weidenbaum Center, Washington University and the Regulatory Studies Center, the George Washington University. Derived from the Budget of the United States Government and related documents, various fiscal years.

We were able to reproduce the negative and statistically significant effects reported in the Phoenix study when we carefully followed their data construction. They included three variables in the VAR: the change in the real regulatory budget as a share of private real GDP, growth in real private GDP per capita, and private employment growth.

However, small changes in the data construction, such as using growth in total real private GDP instead of per capita, rendered the results statistically insignificantly different from no effect. In fact, of all the specifications we tried, only the one reported in the Phoenix study showed a negative and statistically significant result. Furthermore, in most of the specifications we tried we found positive associations between changes in the regulators’ budget and both GDP and employment growth, although they were always statistically the same as no effect. The negative effect appears to come from the definition of regulators’ budget as a share of private sector GDP as compared to total dollars. Our overall findings are that the statistical methods available cannot find a definitive impact of regulatory agencies’ budgets on the macroeconomy, either in terms of employment or in terms of GDP.

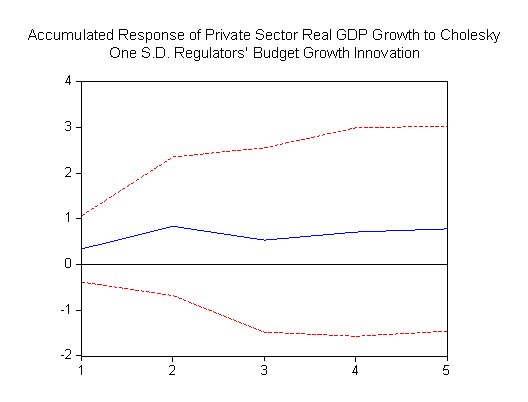

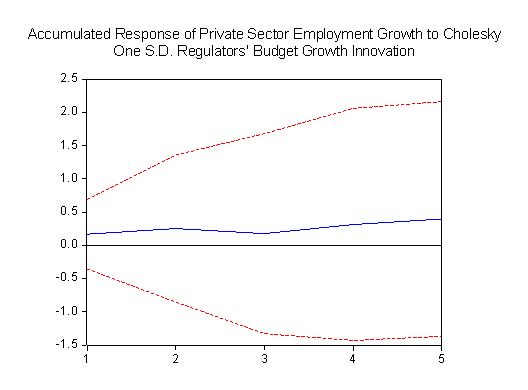

As a fairly typical example of our results, below we present estimates of a VAR(2) with three variables: growth in the real regulators’ budget, growth in real private sector GDP, and growth in private sector employment. Based on Granger-causality tests, we find that growth in the regulators’ budget does not provide additional predictive information for either real private GDP growth or private sector employment growth. Furthermore, we construct impulse response functions (IRFs) identified from a Cholesky decomposition with the ordering of growth of regulators’ budget, growth in private sector employment, growth in real private sector GDP (where this ordering gives equivalent results to the generalized IRFs used in the Phoenix study). The response to a one standard deviation shock to the growth in the regulators’ budget produces the following accumulated IRFs:

The key characteristic to notice is that although the estimates suggest a positive relationship for both employment and real GDP growth with regulators’ budget growth, these estimates are clearly well within the standard error bands which suggest that we’re really finding no effect at all.

The lack of statistical significance in our results could be explained by a number of factors. For example, as is the case with more commonly used proxies for regulatory activity, such as number of pages in the Federal Register or Code of Federal Regulations, the Regulators’ Budget is a blunt measure of regulation. Of particular concern when using this measure is that one substantial outlier in the budget, Transportation Security Administration spending, is by far the biggest driver of regulators’ budget growth over the last decade. It is also possible that different types of regulatory spending have diverse effects on the economy, and that these effects may vary at different times. Our findings suggest, however, that on average the macroeconomic effect of changes in the regulators’ budget appears to be minimal, or at least undetectable based on the data and statistical methods available.

This post written by Tara M. Sinclair

Thanks Tara. Those were eye-catching claims by Phoenix !

It might be interesting to disaggregate by sector, if that’s possible.

We also know that in some cases, like emission reducing technology for coal power, firms take years to implement changes that are expected to take effect at a future date.

It seems like it would be difficult to tease any links to employment and growth from the data due to random variation across firms in the timing and magnitude of their response to new regs.

I’m shocked to find they cherry picked to find the one case that fit their desired ends. Shocked.

Econometrics is the blender of the economics profession. Put in the data, puree, and come out with some causal relationship. But often it’s just lazy, substituting a mechanical process for understanding the narrative of the data.

Why not do a paper on the impact of Type II errors on regulation? We had friends over for dinner on Sunday, one of whom is a long-time public sector employee in New Jersey. She bemoaned the straight-jacket that regulations impose on the bureaucracy. (It’s actually a worse problem for the public sector!) And the reason is that the government does not value Type II statistical errors.

Why not do a piece on that, and for good measure, why not run a root cause analysis and identify what causes the problem. And who knows, maybe suggest an elegant solution.

Thanks for the great suggestions tj and Steven!

tj, sure enough we’re working on disaggregating by different types/sectors of regulation – it should be in our full report coming out early next year.

Steven, I’ll have to think about the Type II errors issue. It’s definitely an interesting one!

Why remove the “per capita”? Isn’t per capita exactly what you’d want to measure to avoid effects of population change? Just the same way that we use real GDP instead of nominal to avoid effects of changes in the value of money (inflation of money supply)?

Julien: The regulatory budget is not in per capital terms, so why should real GDP be?

Steven Kopits

Refresh us a bit, as I recall, type II statistical errors represent the risk of inappropriately accepting false conclusions. Can you give use a couple government examples, maybe that Obamacare will reduce cost and improve care?

AS since Obamacare has yet to be tried we do not know what it will do.

So we know that federal regulation does affected macroeconomic outcomes by first needing taxes to operate and then the proposed cost of following the rules. We don’t know how to effectively measure the results on net and then comes the subjective analysis of the individual rules. Thinking about it I we have (at least should have) known this for over a century.

Most of the regulations that I had to deal with over the years didn’t seem excessively burdensome. The ones that I suspect are problems (OSHA requirements regarding falls and lead paint hazards) just seem to be ignored by the small businesses that are impacted.

I recently sent an email to Mr. Cantor asking if he would please send me a regular listing of his insider market trades.

I haven’t heard back from him.

One might argue that regulations don’t necessarily affect overall employment or growth of various sectors, but it would be hard to convince anyone in the automotive manufacturing sector that regulations haven’t affected the cost, profitability, or size of the sector. One only has to look at the average age of a vehicle to know that vehicles are becoming less and less affordable and that manufacturers are not choosing to do that voluntarily…

… and then there are those coal-fired power plants that can’t be built because our president and regulators want to bankrupt them with regulations… probably to pay for loans to solar cell manufacturers.

Just pointing out that one need not manipulate econometric models. There are plenty of examples.

A rational path driving towards philosophical conclusions.

Regulatories agencies are to conduct rational decision deemed to contribute to 100 million usd every year.Semantic or not beneficiaries need to be identified.

The null hypothesis may as well be predominant when looking at the hereunder facts and figures:

Econbrowser Links for 2011-10-23 ,Fundamentals, speculation, and oil prices

When in situ, that implies after a rational decision has been made and regulations applied, the regulators are still willing to weight the impact of regulations.

Please see:

http://www.gao.gov/new.items/d11529.pdf)

Trends in Energy Derivatives Markets Raise Questions about CFTC’s Oversight

http://www.gao.gov/new.items/d0825.pdf (whilst the whole document is worth reading P78 is exhibiting a trend for the null hypothesis)

Philosophical Shapiro and Morral may rightfully argue that political interplay between analysis and political drive is part of the outcome.

Above comments do apply forcefully in the financial markets and are not confined to the USA.

Should Econbrowser readers not have made money on heating oil (please see Econbrowser posts) then bankers whose survival has,is,and will depend on savers,depositors,tax payers money have an answer for us the 99%.

Bloomberg Bankers Seek to Debunk ‘Imbecile’ Attack on Top 1%

Note that in the 1% productive and intelligent, asinus asinum fricat has sometimes transitivity laws that makes all industry representatives as intelligent as the most productive ones.

Wellll, I had been laboring under the assumption that government regulations frequently started out being expensive to enforce and expensive to comply with. And would usually become more expensive over time, in both senses. I am so glad that you have debunked this assumption once and for all.

Bruce,

I’d be interested to see the money flow from regulations of coal-fired power plants to loans to renewable energy. The financial logic is not clear to me. And thanks for letting us know that your priors include wild assumptions about regulatory motives. In fact, coal-burning plants of all kinds were historically among the biggest polluters of air, land and water. Regulations are, in fact, written in a way that discourages new construction, but only because they grandfather old, unimproved plants. If we had more stringent regulations, we’d have newer, cleaner coal-fired plants.

Anon…

Obviously there can be no accounting within government revenues [taxes] to specific expenditures.

One can infer that since the Obama administration has upped the regulatory costs on coal while lavishly spending on “green” that there is an inherent transfer intended. As for the newer coal-fired plants… Obama was unsuccessful in passing cap and trade to “bankrupt” coal … http://youtu.be/DpTIhyMa-Nw … so EPA regulatory end-runs will accomplish his goal.

And all of that is fine IF the alternatives to coal can provide the electricity this country needs in order to grow economically in comparably priced way. Our goal is not to become the environmentally correct North Korea with an 1850’s economy.

http://mjperry.blogspot.com/2011/12/legacy-of-n-korean-dictator-kim-jong-il.html

Bruce,

Transfers through the tax system to oil, natural gas and coal producers are massively larger than any subsidy to “green” energy, so the financial argument you are making really doesn’t wash. As regards the effort to bankrupt coal producers (your latest) or users (your earlier argument), I can only repeat the point I made earlier – you are just making that up. You don’t know what the motive was and pretending you do is silly.

kharris:

… and just today…

http://www.foxnews.com/politics/2011/12/22/epa-tells-coal-oil-fired-plants-to-clean-up-air-shut-down/

I’ll agree that “subsidies” … aka, normal tax rules … have benefitted fossil fuels more than “alternative energy” simply because the of absolute size differences of those sectors. Now look at it on a kwh and the picture becomes significantly skewed toward so-called alternatives.

I’ll make the point again so you can read slowly:

And all of that is fine IF the alternatives to coal can provide the electricity this country needs in order to grow economically in comparably priced way. Our goal is not to become the environmentally correct North Korea with an 1850’s economy.

Tara M. Sinclair Did the ordering of the Phoneix Center’s Cholesky VAR variables make any difference?

The Phoenix Center’s basic approach seems a bit odd. One of the reasons we want regulation is that the unregulated market imposes real costs not externalized in the price, which suggests that we would expect to see a reduction in measured GDP if that economic activity were reduced. That’s not necessariy a bad thing because measured GDP is only a rough proxy for overall welfare.

The Phoenix Center’s claim about the effect of regulation on jobs sees especially dubious. There’s not much doubt that a regulatory change is likely to induce a temporary unemployment shock as the prices of capital and labor inputs adjust; however, a reduction in regulations is just as much of a change in the regulatory environment as an increase in regulations. The shock effect of change tends to cut both ways.

Regarding the ordering of the variables: The Phoenix Center used Generalized Impulse Responses, which for analyzing only the shock to the regulators’ budget was equivalent to the Cholesky ordering we reported. There was little difference switching the ordering of GDP and employment.

I would also like to emphasize, per the earlier discussion regarding Type II errors, that just because we didn’t find a statistically significant impact doesn’t mean that we found that there is no impact. We simply found that the results are sensitive and that from the analysis we’ve done so far we wouldn’t conclude that there is a clear effect.

The full report is now posted here: http://www.regulatorystudies.gwu.edu/images/pdf/032212_sinclair_vesey_regs_jobs_growth.pdf