Or, how the Tea Party is working hard to sabotage the dollar’s role in global finance.

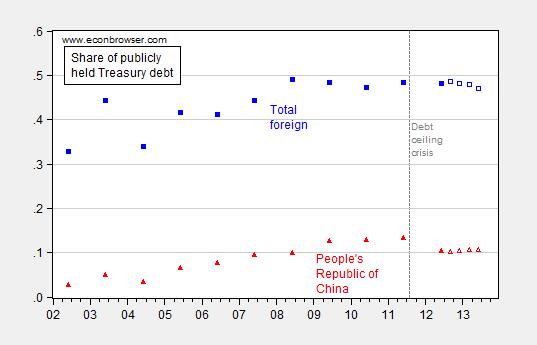

Figure 1: Share of publicly held Treasury debt held by foreign residents (blue squares), and held by China (red triangles). Solid squares/triangles denote data from annual benchmark surveys; open squares/triangles from monthly series. Source: TIC, and St. Louis Fed FRED.

From my op-ed “American Debt, Chinese Anxiety” in the International New York Times on Sunday:

Madison, Wisconsin — Last week, the United States once again walked up to the precipice of a debt default, and once again the world wonders why any country, much less the world’s largest economy, would endanger its financial reputation and thus its ability to borrow.

Though a potential global financial crisis was averted at the last minute, one notable development has been a string of warnings by Chinese officials. Prime Minister Li Keqiang told Secretary of State John Kerry that he was “highly concerned” about a possible default. Yi Gang, deputy governor of China’s central bank, warned that America “should have the wisdom to solve this problem as soon as possible.” An opinion essay in Xinhua, the state-run media agency, called “ for the befuddled world to start considering building a de-Americanized world.”

These statements, unusually blunt coming from the Chinese, show that repeated, avoidable crises threaten the privileged position of the U.S. as issuer of the world’s main reserve currency and (until now) risk-free debt.

It is unlikely that China would provoke a sudden, international financial calamity — for instance, by unloading U.S. Treasury securities and other government debt. Nonetheless, the process of repeated crises and temporary reprieves will only solidify the Chinese government’s determination to diversify its holdings away from dollar-denominated assets. …

Foreign entities — governments, companies and individuals — hold nearly half of the publicly held debt owed by the United States. Of China’s $3.6 trillion in foreign exchange reserves, about 60 percent is estimated to be held inU.S. government securitiesU.S. dollar denominated assets.

As foreign exchange reserves have soared over the last decade, Chinese monetary authorities have attempted to diversify away from dollar-denominated assets, with limited success. The motivation for diversification is understandable: Since July 2005, the Chinese currency has been appreciating against the U.S. dollar, so that in terms of local purchasing power, dollar-denominated holdings have been losing value.

In addition, the fiscal battles in Washington have made the Chinese authorities more anxious. The overarching problem is that over the longer term, U.S. government finances are not sustainable, in the absence of enhanced tax revenues and restrained spending.

However, Chinese policy makers have fairly limited room for maneuver. First, they are locked into a development model that relies heavily on exports as a source of growth. …

Second, most of the earnings received by Chinese exporters are in dollars, so that currency is what the People’s Bank of China accumulates. …

Third, even if the Chinese could diversify their holdings away from dollars without realizing capital losses, the question would be — as always — what is the alternative? …

Does that mean we Americans can rest easy? The answer is no.

To begin with, the fact that fiscal policy is partly in the hands of individuals who don’t believe that debt default is a serious issue understandably makes foreign investors uneasy. …

Moreover, China has been encouraging the invoicing of trade in renminbi, with some success (albeit starting from very low levels). In addition, China is loosening restrictions on renminbi-related financial transactions, with an eye to increasing the Chinese currency’s role in international finance. Eventually, this will mean a reduced demand for the dollar.

Over the longer term, both of these outcomes might be positive from China’s — and the world’s — perspective. However, if timed poorly, they would mean that demand for U.S. Treasury securities would decline at exactly the moment when interest rates on U.S. government debts rose. The resulting strain on government finances is not not be an outcome that patriotic Americans of any stripe should welcome.

I didn’t get to document and elaborate on all the points in the op-ed, so let me extend my argument.

Figure 1 demonstrates that known holdings of US Treasurys by the PRC have declined since the 2011 debt ceiling crisis. What will happen in the wake of the latest self-inflicted debacle remains to be seen.

On Friday, Paul Krugman wrote on the misguided fear that China would imminently dump dollars, provoking a spike in US interest rates. Some people (some commenters here) have taken my op-ed to be a counter to Krugman’s argument. In point of fact, we’re in close agreement; in both of our views, the danger is not an immediate flight from the dollar denominated assets. Krugman writes:

Think about it: China selling our bonds wouldn’t drive up short-term interest rates, which are set by the Fed. It’s not clear why it would drive up long-term rates, either, since these mainly reflect expected short-term rates. And even if Chinese sales somehow put a squeeze on longer maturities, the Fed could just engage in more quantitative easing and buy those bonds up.

That is an analysis perfectly appropriate for 2013, with the Fed embarked upon quantitative easing, extended guidance, and the economy with lots and lots and lots of economic slack.

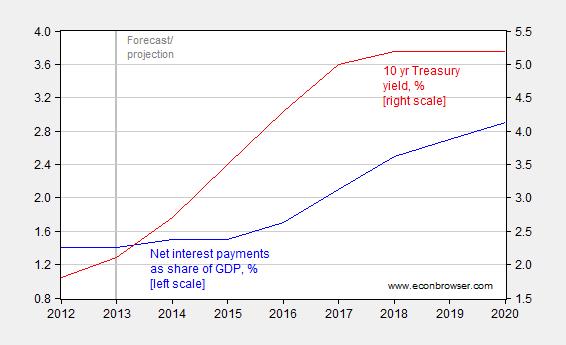

My point was that an increase in default risk will induce China — and perhaps more importantly all foreign central banks and private entities — to have reduced demand for dollar assets over time, relative to what would have occurred in a world without a group of people hell-bent upon Treasury default (technical or not). If that reduction in demand shows up at a time (say five years from now) when demand for credit is rising, then interest rates will rise above what would otherwise occur. Figure 2 depicts projected Federal interest payments and ten year yields, from the February 2013 CBO Budget and Economic Outlook (data for figures).

Figure 2: CBO forecasts/projections of net interest payments as a share of GDP (blue, left scale), and ten year Treasury yields (red, right scale). Source: Budget and Economic Outlook (February 2013) data for figures, figures 1-3, 2-4.

The net interest payments were projected to be 2.5% of GDP in 2018 if the ten year yield were 5.2%; compare against the 2.6% recorded on 10/18. Now, who knows how much of a default premium is built in, and how much more if the Ted Cruz faction can produce yet more debt ceiling standoffs (or an actual default).

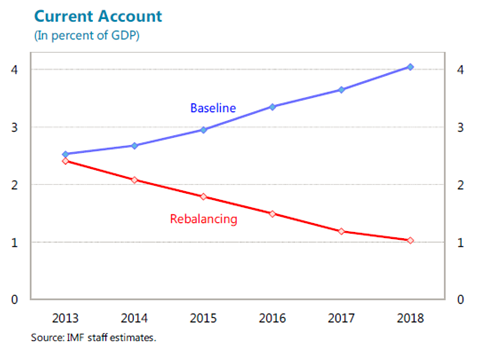

Coming back to China, current projections from the IMF (see Article IV report from July) are for an increasing current account balance from the relatively small levels of 2012 — up to 2.7% of GDP in 2014, and 4% by 2018. By 2018, reserves will be increasing on the order of $668 billion. However, this forecast is clearly predicated on moderate progress on structural reform and a constant real exchange rate. If there is anything the Chinese government has demonstrated, it is that when the political will is summoned, it can undertake substantial changes in policy direction. The alternative, with structural reforms and continued RMB appreciation, the current account balance to GDP ratio could be as small as 1% by 2018.

Figure 3: Chinese current account to GDP ratio in the baseline (blue) and alternative scenario (red). Source: IMF, People’s Republic of China: 2013 Article IV Consultation, IMF Country Report No. 13/211, (July 2013), p.9.

So, imagine a US economy close to potential GDP five years hence, with a considerably smaller demand for US Treasurys, partly because we have made US government debt less attractive. This will result in some combination of a weaker dollar and a higher long term interest rate. Not a good outcome (a weaker dollar due to from a higher exchange risk premium might not be such a bad thing, as Krugman points out). Then we might worry about crowding out, and some of that crowding out will be directly attributable to the actions of those who had no worry about Federal government default.

Background on international currencies here. For more on the RMB as an reserve currency, see here; increasing trading, here; and for a statistical analysis of the RMB as an invoicing currency, see this paper.

Figure 1 demonstrates that known holdings of US Treasurys by the PRC have declined since the 2011 debt ceiling crisis

Wrong. Known holdings of Treasuries by the PRC have INCREASED since the 2011 debt ceiling crisis.

Figure 1 shows the SHARE of outstanding Treasuries held, which has declined thanks to 1) a large increase in total debt and 2) the Fed becoming the biggest buyer. China can’t possibly maintain its share (even if it wanted to) with the Fed buying the bulk of new issuance.

This has NOTHING to do with the US adding $7 trillion dollars in debt in 6 years, and nothing to do with the fact we must issue over $8 trillion dollars in new securities (to cover expiring debt plus new debt issued) this year alone, and EVERYTHING to do with a very small minority of 1/3rd of the power structure of the US political system. Yes, the TEA PARTY is to blame, and not the establishment for adding $7 trillion in 6 years, and nearly $11 trillion in the last decade.

DAMN TEA PARTY!!!

‘…the fiscal battles in Washington have made the Chinese authorities more anxious. The overarching problem is that over the longer term, U.S. government finances are not sustainable….’

Which is the Tea Party position!

wc varones

“Known holdings of Treasuries by the PRC have INCREASED since the 2011 debt ceiling crisis.”

but since our debt and deficit is skyrocketing, shouldn’t the bond vigilantes quit buying our debt and drive up the yield? what possesses the Chinese (and others) to INCREASE their holdings with skyrocketing increases in debt and drop in yields???

The increase has been relatively modest. Meanwhile Chinese gold imports are up big. I’d expect them to continue diversifying away from the dollar.

wc varones

“Known holdings of Treasuries by the PRC have INCREASED since the 2011 debt ceiling crisis.”

but since our debt and deficit is skyrocketing, shouldn’t the bond vigilantes quit buying our debt and drive up the yield? what possesses the Chinese (and others) to INCREASE their holdings with skyrocketing increases in debt and drop in yields???

You can’t dump a trillion in Treasuries without spiking rates, creating losses, and hurting their own exports to the US.

It’s kind of like vendor financing. Subsidize borrowing costs to boost sales. The Chinese know they’ll get paid back in devalued dollars, but that’s just part of the cost of doing business.

I didn’t realize the Tea Party was so stronly opposed to prioritizing debt payments.

Baffling: The world does not work the way academics and the economics texts say it does. Instead, the world works the way it works. Bond vigilantes is a term that obscures for the most part. Global investors is a better term. Global investors are flush with funds from all the global central bank liquidity provision. Investors must put these funds to work. And they will do so in places with the best perceived risk reward ratio. Treasuries fall at a certain place along the risk reward spectrum and have their place in portfolios. Moreover, global investors always have a forward perspective of the yield curve. If the carry is positive, and if the risk of the spread changing unfavorably is perceived to be low, Treasury yields like those today are perfectly acceptable and even welcome. Hence there will in general be no reason for global investors (your vigilantes) to stop buying US debt instruments. That will happen if and only if and only when the perceived cost of carry changes significantly. As at present the bottom of the curve is pegged to zero by the Fed, and Fed guidance is for the funds rate to remain unchanged for a very long time, the textbook notion of what you think should happen is overridden by the key elements of what is going on at the present time. Always it is this way. Interest rates can never be understood via a simple statistical analysis over many quarters and years. Interest rates, both historic and ongoing, can only be understood within the context of a specific time period. And the context changes in a piecewise way chronologically over time. The rate environment is drastically different today. From around 2009 a new context formed. I judge that another new context is just now in the stage of formation. That context being that QE will not go on forever as some had thought. The dividing line between the previous context – or theme if you wish – and now was the period between May and the September FOMC meeting. The newest theme is only now coming into view so I will not try to more fully identify it here.

China runs an export strategy to generate its high GDP growth. This entails accepting US IOUs and reinvesting them in Treasuries. Outside of economics – and this is what economics does not get very well if at all – the Chinese have other goals. To the point, there are two. One is having political leverage over the US via its vast holdings of Treasuries to keep US authorities from rocking the boat of China’s currency manipulation. Another is to strengthen the bond between itself and the US in a rapidly evolving world where all know who the two big players in the future are going to be. That China gets little or no yield on these holdings is of secondary consequence to them. That is, yield is secondary to these other goals. Hence going solely by economic theory fails to explain or predict once again in this instance.

Just finish reading Paul Krugman’s post on sock puppets and presto – I see Patrick R. Sullivan posting here. Go figure. Patrick should try to comprehend what Krugman said about this issue of the Chinese deciding (if ever) to sell some of its holdings of US Treasury. Dollar devaluation leading to more net exports leading to a stronger recovery. As to the Tea Party, their solution to our rising Federal debt seems to be more tax cuts, which would of course lead to even higher deficits.

Varones — Why is that when we have a Republican president the Wall Street Journal Editorial Page keeps pointing out that the correlation between federal Debt and treasury yields is negative —

that is higher federal deficits are associated with lower treasury yields?

Is the WSJ Editorial Page wrong?

When I check the data out I find their analysis is correct.

varones and jbh,

i hear what you are saying. however, there has been an argument occuring since the financial crisis that we must eliminate the deficit and reduce our debt, because if we dont do this quickly armageddon will occur with our interest rates. it seems to me, based on both of your statements, that the inflationistas who said our yields will explode if we don’t impose austerity now were wrong, wrong, wrong (in deference to a previous r stryker response). or they could be correct twice in a broken clock world?

Patrick R. Sullivan: If you are going to quote a sentence, at least quote the entire sentence. The entire sentence is:

That is not the Tea Party position, as they reject any notion of enhanced tax revenues. In fact the Tea Party position would be better written as:

So, please cease your campaign of misrepresentation and just own up to the nature of your views.

Spencer,

I am unaware of the editorial you mention, but it sounds like an awesome case of spurious correlation.

When you “check the data,” I would suggest you add economic and market conditions and Fed policy to the model.

So, Menzie, let’s see if I have this straight. The concern is that foreign demand for U.S. Treasury debt will fall when the U.S. economy is booming, so that the Fed cannot merely buy up the Treasuries to keep the rates down, putting pressure on Treasury solvency. Sounds like a Rube-Goldberg contraption to me. Are you saying that the Treasury will have to worry about default when times are good and tax revenues presumably are high? Or are you merely pointing out that we will lose the reserve currency premium when we are at full employment and the economy is no longer demand-constrained? I would trade that in a flash for some good old fashioned currency flight by China right now, which would improve our employment situation much more effectively than QE.

Menzie wrote:

The overarching problem is that over the longer term, U.S. government finances are not sustainable, in the absence of enhanced tax revenues and restrained spending.

Sorry Menzie but even quoted in Chinese this is the Tea Party position. The difference between you and the Tea Party is that you would actually increase taxes and thereby decrease tax revenue (see Christine Romer). The Tea Party recognizes that a decrease in taxes will increase tax revenue. So your quote is a perfect expression of the Tea Party position – probably better than you intended.

Ricardo: What does the line:

mean? Am I supposed to infer from this that you believe the average translation into and out of Chinese is misleading?

On the other hand, I am unable to decipher your sentence, which is allegedly written in English:

Maybe you meant “tax rates” instead of “taxes”. If so, that typo indicates a detached-from-reality view of the world.

Menzie –

The Tea Party’s reluctance to raise taxes, as I know the sentiment, is two-fold.

First, Tea Party members believe that increased taxes will only increase spending and not decrease deficits. History suggests this is true, and if you’re running a three ideology p-a model, it’s also true. France has tremendous tax revenues and formidable deficits. So providing more revenue does nothing to decrease deficits. It merely gives politicians–of all parties–more money to spend. This has nothing to do with finance, and everything to do with observed political behavior over a long period.

Second, the level of government spending is high. Singapore can provide its services at half the cost in GDP terms. So the Tea Party sees no reason to pay higher taxes. All of us have to economize. The government can as well.

I am frankly surprised that, as an economics and public policy professor, you are so little informed about Tea Party politics.

I would add that I am unaware of any Tea Party member calling for defaulting on US debt. Perhaps you could cite a reference? I believe the Tea Party regularly calls for less spending on social programs, and they are more than willing to see cuts in defense, too, as the sequester demonstrates.

As for the prioritization of government outlays: To the best of my knowledge these are decided by the President in conjunction with the Secretary of Treasury. The President may well be forced to choose between paying Social Security and paying interest, but that’s entirely the President’s choice. To the best of my knowledge, the Congress has nothing to do with it. But again, perhaps you could inform me if I misunderstand.

I would add that the entire purpose of the FAA is to resolve these sorts of issues. I would imagine the very first act under the FAA would be to increase taxes, along with some spending cuts. And Tea Party members would vote for that. Money talks, and it is heard by liberals, conservatives and egalitarians alike.

But I don’t know whether you want more deficit spending or not. So is there a danger in the debt, as Jim would have us believe, or should we just pile it on?

Norway’s Statoil sees the OECD GDP growth rate at 1.5% from 2011-2040. Now, if that’s true (and it’s consistent with the supply-constrained model I’ll introduce at Princeton on Thursday), then you can forget 3% Maastricht style deficits. If a country has 100% debt to GDP, then it will have to run budget surpluses as far as the eye can see–and face colossal interest rate risk in the meanwhile.

You think it will be possible to raises taxes in a 1.5% growth rate environment? I think it more likely that the welfare state–built in so many countries on an inter-generational Ponzi scheme and unaffordable social programs–will continue to unravel, just as it is in Greece, Spain or Italy.

So if you think traditional growth rates are not going to return, then life takes on a very Tea Party hue, and it’s all about paring down spending and bringing the budget back into balance. That’s what all the noise is about.

JBH

Everytime you post it is spot on A+ material. You should have your own blog.

=============================================

Spencer,

“keeps pointing out that the correlation between federal Debt and treasury yields is negative —

that is higher federal deficits are associated with lower treasury yields?”

correlation =/= causation. Deficits are high and yields are low in a recession.

ricardo, how did tax revenue and deficits behave during the reagan and wbush tax cuts?

Menzie can you link to the official tea party position of anything?

PS there isn’t one.

Ricardo-

“The difference between you and the Tea Party is that you would actually increase taxes and thereby decrease tax revenue (see Christine Romer). The Tea Party recognizes that a decrease in taxes will increase tax revenue. So your quote is a perfect expression of the Tea Party position – probably better than you intended.”

This is really a case by case basis. What tax and on who? If the tax rate was 1% and you set it to 0%, you wouldn’t get more.

One this I will say is that libs are mentally ill if they think raising tax rates is wise. I make sub 100K and my marginal income tax rates are around 45%. This isn’t exactly incentivizing me to try to produce more. Tea Party nuts would probably go for lower rates at the expense of fewer deductions and lower spending.

After all, SPENDING is taxation. Taxation is just who pays what when, but in the end, all spending is taxation that will be paid for, by someone.

Maybe you meant “tax rates” instead of “taxes”. If so, that typo indicates a detached-from-reality view of the world.

Posted by: menzie chinn at October 22

Come on menzie, this is just not true. There would be ways to increase revenues with lower rates and fewer deductions. I know you know this.

1. It’s funny to see the conversation about taxes devolve to “rates” versus “deductions”. There has been chatter about that in DC but no substance of note. In the tax cut ideology, a decrease in deductions is a tax increase and thus is an absolute no – unless, it seems, the scaling back is of the EIC and other measures meant to encourage work and assist the poorer people. The idea of “skin in the game” heard so often means raising taxes on poor people. That idea flies in the abstract but I haven’t seen much fervor for actually voting to increase taxes, whether by limiting deductions or otherwise.

2. With regards to Menzie’s op-ed and post, I think he and Krugman are looking at different time horizons and that Krugman is somewhat more sanguine about the long run because he possibly sees value in a more balanced international monetary situation. A lot of people do. I think these days will be written about in decades to come as a turning point in American fortunes, as an inflection point where the world shifted. It’s ironic, in a way, that we spend more than nearly all other countries combined on our military – like the next 25 together! One aim of that is to maintain our prestige, meaning we see value in being seen as THE important country. We clearly don’t get much value from these gigantic sums in discouraging relative handfuls of terrorists. Maybe we are deluded by our belief in our own power.

menzie,

i would be interested to see plots of government receipts and outlays plotted together, with a plot of deficits superimposed on a secondary axis. all plotted by year (and perhaps identified by president). it would be interesting to see who presided over increases in receipts, increases in outlays, and changes in deficit. also identify when significant tax hikes and tax cuts occur?

i acquired some historical tables from the white house office of management and budget, but not sure which ones are appropriate for this comparison. perhaps you have an idle grad student looking to make a contribution 🙂 keep up the good work on the blog.

Patrick R. Sullivan Which is the Tea Party position!

No, here are the Tea Party positions:

(1) Oppose Medicare entitlement spending for future generations, but keep your government hands off Medicare for the current crop of geezers.

(2) Chain CPI for future Social Security retirees, but no cuts for the current crop of geezers.

(3) Worry about high interest rates for future generations, and then bemoan the current low interest rates for today’s generation of geezer savers.

(4) Pretend to be concerned about future generations as the retired geezers enjoy their golden years while driving their gas guzzling RVs.

(5) Work to defund Obamacare for young workers even though Tea Party geezers are covered by Medicare.

Being a Tea Party supporter means never having to say the rules that apply to others apply to you.

Historical note: Today’s Tea Party members really should read some history. There’s a reason the true identity of the criminals who dumped that tea into the harbor hid their identity for 50 years. Even supporters of Independence regarded them as criminals and hooligans who wantonly destroyed private property.

American idiom note: Today’s Tea Party geezers really don’t want to know why so many young people call them “teabaggers.”

I wonder if someone can help me out with an argument I’m having with my brother. I’m a big supporter of the President’s plan to bring affordable health care to all Americans. But my brother is saying that what I’m planning to do with my own business just proves that the tea party was right.

Here’s my situation. I run a medium size manufacturing company in Fairfax, Va. My typical employee is married, has 2 children, and makes about 60K. We had a consulting company come to analyze our insurance and they’ve found a way for us to increase our employee’s take home pay.

Right now, we have a great health insurance plan. The company pays 12K per year per employee while the employee pays 2K. However, the consulting company recommended we end our company health plan and send our employees to the exchange.

In Fairfax, a silver plan (PPO) runs 12,721 per year on the exchange. If you make 60K with a family of four, you are at 255% of the poverty level and the maximum you can pay is 8.19% of your income. Thus, a silver policy will cost 8.19% X 12,721 = $4914 with the federal government picking up the remaining $7807. So the idea is to cancel our insurance and pay each employee an additional 10K. That leaves 2K for us to pay the employer penalty for not providing insurance. And, since the President used his almost unlimited powers granted to him by the constitution to delay the employer mandate this year, the company can pocket the first $2K.

We’ve told our employees that with a marginal tax rate of 20% they will have an additional $8000 after they pay the tax on the $10K. Also, they will have the $2K they spent on the employee health care contribution, which is $10,000. Now since they can buy the silver plan for $4914, they will each have $5086 left over. Once they pay the penalty of $600 (only due if they are getting a tax refund), they will be ahead by $4486.

It seems that everyone wins. We get rid of the hassle of providing insurance. And our employees get the big screen tvs and home entertainment systems they’ve had their eyes on over at Best Buy.

Of course, some of our employees aren’t happy with this. They say the President promised that if they like their plan and their doctor, they will be able to keep them. However, we tell them that the President really cares and would never allow them to have worse insurance or doctors. We also keep reminding them about their new home entertainment system. Makes a lot of them feel better about it.

Other employees are even happier. They are saying that if they don’t buy the insurance on the exchange, they’ll have even more money left over. They think that if it turns out they really need it, they can always buy it later, since no one can be excluded.

My brother’s argument is that the government will spend more money than anyone ever expected. For every employee moved to the exchange, the government will spend $7807 and will get back $1500 in taxes, for a net spending increase of $6307. He says employers all over the country will do what I’m doing. He says that Medicare will never truly be cut. He says Obamacare contains all kinds of other incentives for spending to rise. He says that Obamacare might even end up reducing the level of insurance. He claims the tea party was ultimately right to stand up to the orgy of spending that’s coming from Obamacare, if the system doesn’t implode first. He says Professor Chin, if he’s truly worried about the long term fiscal budget constraint, should be congratulating the tea party for their efforts instead of attacking them. (I don’t know what my brother means by fiscal budget constraint. He’s always talking that way.)

I know my brother’s wrong since he’s an evil conservative Republican who doesn’t want people to have health care. I also know the President has put the best and the brightest people on Obamacare, just as he has on the website. Those intellectually and morally superior people will know how to stop the spending my brother claims will happen. But I don’t know how to prove it. Can anyone help me?

rob stryker,

you should talk to your stupid brother’s son before you take his advice. last i heard, the kid dropped his insurance upon dad’s advice, and was passed out drunk in the gutter when he was taken to the hospital. you may be able to share his bankruptcy lawyer when you get your hospital bill. of course, don’t expect a handout from your brother to help with the bills-he disowned his own son after that fiasco. lesson: don’t be a deadbeat. i hear the faint chant of personal responsibility coming from rick’s room…

Sorry, wrote this too fast. A couple of corrections:

It’s 8.19% X 60K = $4914.

Also, if the employee buys the insurance, he doesn’t have to pay the $600 penalty, so he will have $5086 extra. However, if he chooses not to buy the insurance and pays the penalty, he will be ahead by $10,000 – $600 = $9400. But the employee will only pay the penalty if he has overpaid his taxes.

Rick and Rob Stryker, excellent explanation of the economic incentives of the ACA.

Menzie,

Your comments on my post reveal that you totally understood my post. Thanks for correcting the misphrasing of taxes verses tax rates.

My comment about even in Chinese means that no matter what language – Spanish, Russian, Dutch – you write choose to write the sentence, it still means the same thing and describes the Tea Party position. Why are you so afraid to get something right?

Could the responsible person please stop posting as Rick Stryker’s son or brother and let Rick post his own views when he wants to comment on a topic.

I don’t see much value in a comment that doesn’t have a real person behind it to explain it, defend it, or, at the very least, allow me to see how others are thinking about and responding to a topic.

Now if we could just do something about the FAA spambot…

“Menzie can you link to the official tea party position of anything?

PS there isn’t one.”

Posted by: Anonymous at October 22, 2013 01:49 PM

Fight illiteracy and go and inform your self…

http://www.teaparty-platform.com/

You mean me, Ottnot?

Hans: Inform “your self”? And you want me to correct my illiteracy?

“Come on menzie, this is just not true. There would be ways to increase revenues with lower rates and fewer deductions. I know you know this.”

OK – we could afford to give the very affluent a small tax rate cut (losing quite a sum of tax revenue) and more than offset that by getting rid of big deductions for the middle class and working poor. Which of course takes from the poor and middle class and gives to the rich. But that is not quite Paul Ryan’s proposal. His proposal qualitatively does the same but the size of his tax rate custs gives more back to the affluent than it takes from the rest of us. Which lowers overall tax revenues. Which of course is what Menzie wrote.

2slugs and Menzie, compare your beliefs re: the Tea Party with their own public platform, then get back to us.

Hans (twice) provides us to a link to some very vague policy positions from the Tea Party. If #3 is to eliminate the deficit immediately, I guess the debt stops rising. But that means it is not eliminated (their #2). A little math error? Well not as bad as the inconsistency between #3 and #1? Cutting taxes to cut the deficit? Didn’t we once call that the Laugher Curve? Alas Hans has not provided us with a platform per se but just a bunch of silly talking points.

ottnott, couldn’t agree more. rick stryker bases his argument on two fictional characters. but alas, that has been the conservative argument since the affordable care act was passed. we have been hearing for years how it is costing hypothetical people jobs and money-but the law was not even in effect! all hypothetical squawking.

CoRev wrote:

Rick and Rob Stryker, excellent explanation of the economic incentives of the ACA.

You should apologize to Rick for attributing that error-ridden comment to him.

Some of the missing info:

–firm now pays payroll taxes on the extra $8000 to the employee and loses the deductibility of the $2000 it skimmed from employee compensation.

–employee will have to pay more for the exchange insurance due to the $8000 increase in salary and the conversion of the $2000 employee cost for employer-sponsored insurance from pre-tax dollars to taxable income.

–employee will have to pay more federal, state, Social Security, Medicare, etc. on the $10,000 increase in taxable income (not just 20% income tax on $8000, as the comment suggested).

–an employee who is getting only personal health insurance coverage from the firm isn’t costing the firm $10,000 or even $8000 in employer premiums and very likely won’t qualify for any federal subsidy for exchange insurance, so the firm takes a hit, the employee gets a bonus, and the government tax coffers will see an increase in payments from the firm and the employee.

–assuming that the firm doesn’t deliberately hire dimwits, the “typical” employees will notice that the firm was not satisfied with the savings realized from dropping the administrative burden of maintaining an employer-sponsored health insurance plan, and chose to skim $2000 each from the employee compensation budget. Way to show employees how much you value them.

Fight illiteracy and go and inform your self…

http://www.teaparty-platform.com/

Posted by: Hans at October 23, 2013 07:59 AM

Hans, you seem mentally ill. This is just someone’s web page. Link to official tea party web page?

Hint: There isn’t one.

ottnott concludes: ” Way to show employees how much you value them.”

And Baffled claims: “but the law was not even in effect! all hypothetical squawking.”

When time after time we see these articles: http://www.wnd.com/?s=2013+10+300000+lose+health+plans+in+florida

and these kinds of analysis: http://thebasispoint.com/2013/07/19/part-time-jobs-increase-full-time-jobs-decrease/

Which includes these nuggets:

“2) Full time jobs are barely increasing. Since the start of 2013, 557,000 of the 753,000 more people working are part-time employees. That’s an increase of 196,000 full-time jobs in 6 months.”

and

“3) The most recent jobs report shows that 19.5% of jobs are part-time. When the Lehman BK occurred about 17.0% of jobs were part-time.

There are currently 5.5 million fewer people working full-time then there were when the Great Recession started (December 2007). In that time there are 3.2 million more people working part-time.”

How many reports of unions claiming we are becoming a “part time” employment nation, employers converting jobs to part time, and reducing employee healthcare coverage before the deniers of reality begin to accept the unintended consequences of the ACA?

corev

“There are currently 5.5 million fewer people working full-time then there were when the Great Recession started (December 2007). In that time there are 3.2 million more people working part-time.”

I suppose ACA created this? it probably has nothing to do with the financial crisis and resulting recession? or did ACA cause that as well? just waiting for you numbnuts teabaggers to blame the financial crisis on ACA!

Getting back to Menzie’s main point:

“Third, even if the Chinese could diversify their holdings away from dollars without realizing capital losses, the question would be — as always — what is the alternative? …

Does that mean we Americans can rest easy? The answer is no.”

I think the right answer is yes. I think the U.S. would be better off if China had never amassed its huge stock of dollar reserves. Now, you may say that the question is about going forward, given the legacy of past policies. I would argue that the U.S. would gain under current economic conditions if China started to divest itself of its Treasury holdings, and I am completely unafraid of the effects of such a policy at a time when U.S. AD is plentiful. (Are you seriously arguing that we would need to fear solvency at such a time, or just that we would lose the reserve currency premium – free goods for paper money. I doubt the latter has much long term value, after deducting the costs during periods of AD shortage.)

I have a very hard time going from Krugman’s view that we would benefit from such actions now, to your view, which appears to be that we should worry about such a policy in future. Nor did I notice any qualifiers in Krugman’s agreement with the statement “China is holding an unloaded squirt gun to our heads,” where he says conditions might be different down the road.

Baffled in his unique way says: ” just waiting for you numbnuts teabaggers to blame the financial crisis on ACA!”

Let me get this straight: 1) Blame the GOP for the shut down.

2) Blame the shut down on GOP strategies to delay ACA implementation.

3) Deny that those two things are the cause of some reduced outputs during the shut down.

4) Deny that the ACA roll out is a disaster.

5) Exaggerate the impacts to “financial crisis”.

Better, less hypocritical trolls, please.

ottnott concludes: ” Way to show employees how much you value them.”

And Baffled claims: “but the law was not even in effect! all hypothetical squawking.”

When time after time we see these articles: http://www.wnd.com/?s=2013+10+300000+lose+health+plans+in+florida

and these kinds of analysis: http://thebasispoint.com/2013/07/19/part-time-jobs-increase-full-time-jobs-decrease/

Which includes these nuggets:

“2) Full time jobs are barely increasing. Since the start of 2013, 557,000 of the 753,000 more people working are part-time employees. That’s an increase of 196,000 full-time jobs in 6 months.”

and

“3) The most recent jobs report shows that 19.5% of jobs are part-time. When the Lehman BK occurred about 17.0% of jobs were part-time.

There are currently 5.5 million fewer people working full-time then there were when the Great Recession started (December 2007). In that time there are 3.2 million more people working part-time.”

How many reports of unions claiming we are becoming a “part time” employment nation, employers converting jobs to part time, and reducing employee healthcare coverage before the deniers of reality begin to accept the unintended consequences of the ACA?

Workers part-time for economic reasons made up 7.1% of employed workers in 2010. That number is now down to to 5.7%. The trend has been pretty consistently down since 2009, though perhaps it is leveling off now. (Month to month changes are too volatile. Should compare with prior years.) If you use part-time for economic and non-economic reasons (not sure why you would) part-tiem has dropped since 2010.

http://www.advisorperspectives.com/dshort/commentaries/Full-Time-vs-Part-Time-Employment.php

Well, well, well.

As many of us predicted, the Washington Post is reporting that the deadline for buying insurance to be in compliance with the individual mandate has been extended by 6 weeks.

Of course, the Administration is spinning this as no change, just a clarification of the rules. Obviously, the Administration is starting to appreciate the problems with the Obamacare website. I was shocked to read that the site has 500 million lines of code, of which 5 million must be re-written. I keep wondering if that’s some sort of mistake, but I keep reading it. Just to contrast, Facebook is about 60 million lines. OSX is about 85 million lines. Most likely, this site will need to be re-written if they really need to touch 5 million lines of code. That means the eventual delay will be much longer.

Remember, there could be no compromise with Republicans on a delay since this was “the law of the land.” The Administration was willing to shut the government down over this. Amazingly, we have learned from reports that HHS tested the site a few days before launch and it crashed with just a few hundred concurrent users. So, the knew what the problems were. But they couldn’t compromise on this.

Meanwhile Menzie is blaming the tea party about China.

“the deadline for buying insurance to be in compliance with the individual mandate has been extended by 6 weeks”

That’s excellent news. With the caps on annual out of pocket costs, the elimination of annual limits on covered care, and the guaranteed coverage of pre-existing conditions, the more people who have a chance to sign up means the more families who won’t find themselves suddenly bankrupted by an illness or injury.

People who have been planning to start a small business could be big winners under ACA. They can be certain of getting a solid plan for every one in the family, and, while the business is getting started and producing little or no profit, the family may qualify for a high subsidy rate. The ACA really reduces an important risk element for prospective entrepeneurs.

Rob Stryker and Rick Stryker Jr,

Thanks for your effort. I think you are making the right points about the incentive effects of Obamacare. However, Ottnott is looking for a more precise analysis so let’s give it to him.

Let’s assume that we have a 100 person company. The average annual employer contribution is 11,786. The average annual employee contribution is 4,565. That’s a total annual cost of 16,351.

Now let’s assume that the company wants to put it employees on the exchange. For each employee, it will have to pay a $2000 fine. Since ACA mandates that this fine can’t be deducted from income, we’ll have to gross up for the corporate tax rate, which we’ll assume is 30%. But it’s also true that you don’t pay a fine on the first 30 employees. So the total fine is 70 X 2000/.7 = 200,000. Per employee that’s 200,000/100 = 2,000. So we start by subtracting 2,000 from 16,351, which is 14,351.

Next, the employer will need to pay 6.2% in social security taxes and 1.45% in medicare tax, for a total tax of 7.65%. Thus, it will pay out in income 13,331 and use 1,020 to pay the payroll taxes. (13,331 + 1,020 = 14,351; 1020 = 7.65% X 14,351). So each employee now has 13,331 in additional income.

Let’s work through the case of a 50-year old couple with 2 children. Their silver plan will cost about 12,721. Let’s assume their income is 60K so that with the extra income they now have 73,331. Their premium is capped at 9.5% of their income. So, their maximum annual payment is 9.5% X 73,331 = 6,966 and their subsidy is 12,721 – 6,966 = 5,755.

Since they have an additional 13,331 in income they will have to pay taxes. For a married joint filer, the federal marginal tax rate is 15% up to 72,500. This couple has a little more income than that but just to keep this simple I’ll use 15%. The social security tax rate is 6.2% and medicare is 1.45%. The Virginia tax rate is 5.75%. So the total tax rate is 28%. Thus, after tax, the couple will have 13,331 X (1- 28%) = 9,545. After they pay their premium, they will have 9,545 – 6,966 = 2,579. That is indeed enough to visit the entertainment section at Best Buy.

Now, what about net taxes paid to the federal government? The government pays out the subsidy of 5,755. What do they receive? First, they get the 2,000 penalty. Then they get the federal, social security, and medicare tax on the additional income, which is (15% + 12.4% + 2.9%) X 13,331 = 4,039. In all, that’s 6,039. Since the government paid out 5,755, the federal government gets a net payment of 6,039 – 5,755 = 285.

Looks like there is no problem then, right? Not exactly. These numbers depend a lot on the situation. Here is what the same calculation looks like for different starting income levels:

Income Excess Net Federal taxes paid

40,000 5,689 -2,826

45,000 4,896 -2,033

50,000 4,099 -1,235

55,000 3,252 -388

60,000 2,579 285

Thus, we can see that the lower the income, the greater the excess of after tax income over the health care premium and the lower the net taxes paid. At an income of 40,000, the family would have an additional 5,689 in after tax income after paying for health care and the federal government would pay an additional 2,826.

These numbers also depend very much on the age of the couple. If the couple is younger, the premiums are lower and therefore the federal subsidies are lower. Here are the numbers for age 40 and age 30.

Age 40

Income Excess Net Federal taxes paid

40,000 5,689 195

45,000 4,896 988

50,000 4,099 1,786

55,000 3,252 2,633

60,000 2,579 3,306

Age 30

Income Excess Net Federal taxes paid

40,000 5,689 500

45,000 4,896 1,293

50,000 4,099 2,091

55,000 3,252 2,938

60,000 2,579 3,611

Notice that the excess amounts are the same. That’s because both the after tax income each couple receives and the maximum cost of insurance is independent of age. The maximum cost of insurance only depends on how far above the poverty level the family is. However, since the price of insurance does depend on age, the federal subsidy is lower if the couple is younger. That’s why the federal government comes out ahead on taxes the younger the family is. But it’s clear that employers have an incentive to end employer insurance and employees have an incentive to go along when you look at the excesses.

What’s the problem then? It’s that dreaded adverse selection that has the White House terrified. Rick Stryker Jr. was pointing out that young, healthy people don’t necessarily have a lot of incentive to sign up. And Rob Stryker noted that families kicked onto the exchanges might decide not sign up for the insurance and keep more after tax income. Ironically, since you can’t be turned down for having a pre-existing condition, the value of having insurance is lower and many people may decide not to purchase it. Worse, the healthiest people will tend to avoid buying insurance and those who need it most will spend weeks on the website trying to sign up.

What will happen if adverse selection forces insurance companies to raise the average premium on the exchanges 50% next year? Here is one achilles heel of the system. The employer penalty is indexed to the rate of change of the average global increase in all premiums. If that is 25% overall, then the employer penalty will go up from 2000 to 2500. But the price of a 12,000 policy on the exchange will go up by 6,000. Thus, the federal subsidies will be much higher. Here is what the numbers will look like for the 3 cases:

Age 50

Income Excess Net Federal taxes paid

40,000 5,390 -8,861

45,000 4,601 -8,071

50,000 3,806 -7,276

55,000 2,962 -6,432

60,000 2,290 -5,761

Age 40

Income Excess Net Federal taxes paid

40,000 5,390 -4,329

45,000 4,601 -3,539

50,000 3,806 -2,745

55,000 2,962 -1,901

60,000 2,290 -1,229

Age 30

Income Excess Net Federal taxes paid

40,000 5,390 -3,872

45,000 4,601 -3,082

50,000 3,806 -2,287

55,000 2,962 -1,443

60,000 2,290 -772

That looks really bad across the board for costs to the government. It’s very plausible to think as well that companies with lower income employees will tend to get dump them on the exchange more frequently, since the rewards to doing so are greater. That makes the costs to the government even worse. Also, note how much the after tax, after insurance excess gets smaller with higher income. Those are the marginal tax rates effects Casey Mulligan is talking about.

When you look at the second set of numbers, you can see how important it is for the website to work. The longer this goes on, the more likely it is that adverse selection will prevail, with rates going up next year. And the more likely this thing implodes.

The Administration really should have agreed with the Republicans on a delay.

Professor Chinn, I was directing the quote to Anonymous The Petty.

Hear, go and inform your-self:

http://www.freedomworks.org/press-releases/republican-party-adopts-majority-of-tea-party%E2%80%99s-%E2%80%9Cf

There is one thing that the left does excel in and that is fear-mongering..Our beloved Professor worries about a technical default and quickly finds a prominent villain but like Dr Krugman says little about the mounting federal debt, which in the long run is a threat of our economic liberties and freedoms..

Moreover, there seems to be words of adulation of Red China and it’s blood stained currency…

America needs no lectures from these central planners and their politburo…The Chicoms are no friends of ours or world peace for that matter…

Corev and Stryker, excellent posts..

Congrats to Professor Chinn to his accession to the INYT!

Ottnott,

In further good news, it looks like some open source volunteer developers fixed the website much faster than I thought possible. Here is an alternative link that budding entrepreneurs can use to sign up.

Rick Stryker, great site! I got right in and the link to the Fed Application process went just as expected.

If nearly half of U.S. adults do not pay federal income taxes and the federal spending as a percentage of GDP is relatively flat… and the federal deficit as a percentage of GDP is growing, then there are two “solutions” that seem to be the center of arguments between the “Tea Party” and the “Progressives Party.” Either cut spending or raise taxes on the 50% that are paying taxes.

Perhaps a better approach than either is to seek policies and processes that are not as inimicable to prosperity as the present. If the past 5 years have shown anything, the present policies and processes of our Federal government have been quite pallid when it comes to general prosperity. We have a plethora of programs to help this special group or that special interest or to provide “safety nets” for those whose participation in economic growth or funding government is limited or none existent. We have a plethora of regulations to limit and hamstring the rest of those who are productive and fund the government in the name of “fairness” and “responsibility.”

Do we need massive subsidies for social engineering and not-ready-for-primetime “solutions?”

“The American Republic will endure until the day Congress discovers that it can bribe the public with the public’s money.”

― Alexis de Tocqueville

Apparently, massive subsidies and taxing only half the people are effective enough bribes to keep professional congressmen in office even if it threatens the sustainability of our nation.

We’d better raise taxes some more.

I for one have no problem with a 6 week extension to sign up for ACA, if that allows me and others to access affordable health care. not sure how a one year delay would help me one bit? maybe let the republicants try to further deconstruct the ACA-not in my or the country’s benefit. 6 or even 8 weeks is much better for me. rick, corev and other numbnuts, why would you want me to not acquire affordable health care? perhaps you could share your policy with me? or allow me to tag along on ted cruz gold plated goldman sachs policy? why do you hate your neighbor soooo much?

bruce hall,

perhaps we could cut some defense spending? we spend as much as the next 15+ highest countries combined. you could reduce tax dollars with those cuts. and maybe a smaller military would make it less likely to wage war around the globe-how much more could you save without wars in afghanistan and iraq? spend a litte less time, money and effort nation building overseas and a little more right here in the good ol USofA.

Baffled, comes back to Bruce Hall with the traditional Progressive/Liberal/Democrat war scam argument. How many times do we need to follow the misbegotten policy? They always end up the same, war. The worst example was WWII. The most recent was 9/11/2011, and with a little imagination we can point to Benghazi.

Smarter trolls, please.

Bruce,

Libs will be quick to point out that you’re referring income taxes. But your point is worse than you’re letting on. Only half of people who FILE taxes pay income tax, not half of adults.

baffled

IT IS NOT AFFORDABLE YOU NITWIT.

yes, let’s cut defense spending

let’s also cut spending on the last 6 months of life, which amounts to some ungodly amount of medicare like 30%

Sane rational people can see what we need to do, but unfortunatly the masses of dolts are voting.

CoRev Please check your sources

As political scientist John Pitney (a professor at Claremont McKenna College with a fine scholarly record and experience in Republican politics) notes, this quote is bogus.

anonymous,

go talk to palin about the death panels which so riled up the tea baggers. and you think currently purchasing a private health insurance policy is affordable?

corev,

are you happy with the current amount of money spent on defense? you want to avoid government waste and efficiency, perhaps you can find a few hundred billion $$ in military-industrial complex spending that is not needed. you don’t like this response, but extremely large defense spending is a fact! and we paid for it with……tax cuts! and you wonder why we have a deficit? this was self inflicted.

i’m not trolling any longer, i hooked the biggest rube on this site!

Robert Hurley, care to hint at which “quote” of mine to which you refer?

Sincerely and extremely Baffled, Why would I not like your response of cutting some defense spending? Of course we can find some savings in ~1/2 the annual budget. What’s so amazing about that. We can find savings in the other half also. I even told you how to achieve those budget savings. IIRC there are $100Bs if we clean up medicare fraud.

We need smarter Rubenesque trolls. Kinda off topic, but if you are describing your preference in female body style, it’s OK?

corev, since we both agree on defense cuts, you can keep trumpeting those spending cuts. no need to cut the “other half,” since i’m not interested. you should be happy we are cutting spending in any area. life is good for us both! rube

Corev asks:

How many reports of unions claiming we are becoming a “part time” employment nation, employers converting jobs to part time, and reducing employee healthcare coverage before the deniers of reality begin to accept the unintended consequences of the ACA?

Reality answers:

“According to the Bureau of Labor Statistics’ household survey, part-time jobs fell 594,000.

Full-time workers were up 691,000.

This was the second straight month of part-time jobs falling.”

http://www.businessinsider.com/september-part-time-jobs-2013-10

Reality can snort with derision. Who knew?

Baffled, elucidates the depths of his thinking: “no need to cut the “other half,” since i’m not interested.” You’re interest(s) matter to whom?

Clearer thinking and less arrogant trolls, please.

Ottnot, OK. Tell Trumpka.

corev, you got spending cuts-so what is your complaint? ahhh, but you have intersts in cutting the other half? why is that an interest of mine? you are a rube shut into your own little fantasy world. your the kid who gets “doesnt play well with others” on his report card! simpleton rube. then you get no cuts at all.

ottnott,

Reality? That data has to be made up.

“In brief: according to the BLS’ magic calculations, in one month, the month during which the so-called uncertainly surrounding the government shutdown hit its peak (if one listens to CEO apologists), the US work force saw the rotation of some 594K part-time workers into a whopping 691K full-time jobs, in addition to adding over 100K net new jobs in the month.”

http://www.zerohedge.com/sites/default/files/images/user5/imageroot/2013/10/Full-Time%20Jobs.jpg

http://www.zerohedge.com/news/2013-10-22/us-somehow-adds-691k-full-time-jobs-september

corev says: Ottnot, OK. Tell Trumpka.

I don’t know what Trumpka has said, so I’m not going to presume to give him a reality smack based only on your suggestion.

The info I posted was for the country as a whole. I don’t know what might be happening in the industries and segments of interest to the leader of a specific labor union.

Baffled, your commenting is getting less and less rational, and your name calling is more infantile/immature.

More mature and rational trolls, please.

anonymous, and your blog source is not biased???? really??? at least you got me to chuckle!

Anonymous wrote:

ottnott,

Reality? That data has to be made up.

What you are really saying is “the data doesn’t fit my worldview, so the data must be fake”.

I say that, because a thoughtful skeptic would consider the possibility that ordinary volatility of that BLS dataset, and ordinary measurement errors, and the imprecison of seasonal adjustments, and one-time events coincided to produce an outsized one-month change that will smooth out in the months ahead.

The historical data shows that moves of similar magnitude have occurred, in both directions, multiple times since the end of the recession.

Zerohedge’s belief that the data is fake appears to be reinforced by ZH’s assumption that the possibility of an Oct 1 government shutdown should have discouraged the switch of workers from part time to full time in September. Maybe, but I can envision the threat of shutdown stirring up a lot of activity, as one might see when a storm approaches. Federal contractors and grant recipients, for example, may have rushed to get a much billable work performed and invoiced as they could in advance of the shutdown. I know I would have.

Assuming that unexpected data is fake is a dangerous practice. It allows one to be “blindsided” by a blow from straight ahead.

anonymous:

I forgot to add that Doug Short provides a level-headed review of the BLS data, with his usual array of useful graphs. He is very unlikely to ever get blindsided by the data in front of him.

http://advisorperspectives.com/dshort/commentaries/Full-Time-vs-Part-Time-Employment.php

corev, if you can’t handle the truth, not my problem. go back to your faux news worldview and put a smile on your face. thin skinned rube.

Baffled, which truth do you wish me to handle? I’m quite happy with my life. You seem quite unsettled with yours.

Better balanced and less angry trolls, please.

CoRev, I have place him on my ignore list…

Hans, a good decision. I did for a while, but then decided to give back what was given. Old guys like me have little patience and little to lose for low level thinkers.

hans and corev, please do ignore me and go back to your faux news world. we don’t need to hear any more of your propaganda on this site anyways.